Manage The Callable Function (The Response Handler)

PayTabs provides you with the backend packages that make the integrating with PayTabs payment gateway very easy by providing ready-made classes that handle the payment process.

This article is dedicated to walking you through how to manage the callable function to receive the PayTabs sent response for your initiated payment request. You can initiate a function in which you will handle the sent payment response according to your business needs and pass it as the paymentPageCreated parameter, which is passed as the eighth parameter to the createPaymentPage function, as shown below:

Method Specification

That the callbackMethod parameter is Mandatory, not passing it would throw an exception.

| Description | Create the Payment Page. |

|---|---|

| Since | 1.0.0 |

| Required | ✔ |

| Signature | |

| Sample | |

Method Parameters:

CallbackMethod

| Name | callbackMethod |

|---|---|

| Type | callback |

| Description | The eighth parameter to the createPaymentPage> function, which manage the callable function that receive the response of the initiated payment request. |

| Default | - |

| Required | ✔ |

| Example | |

Expected payment flow behaviour:

- As a merchant you would initiate a payment request per the above Specifications, which include a sample code.

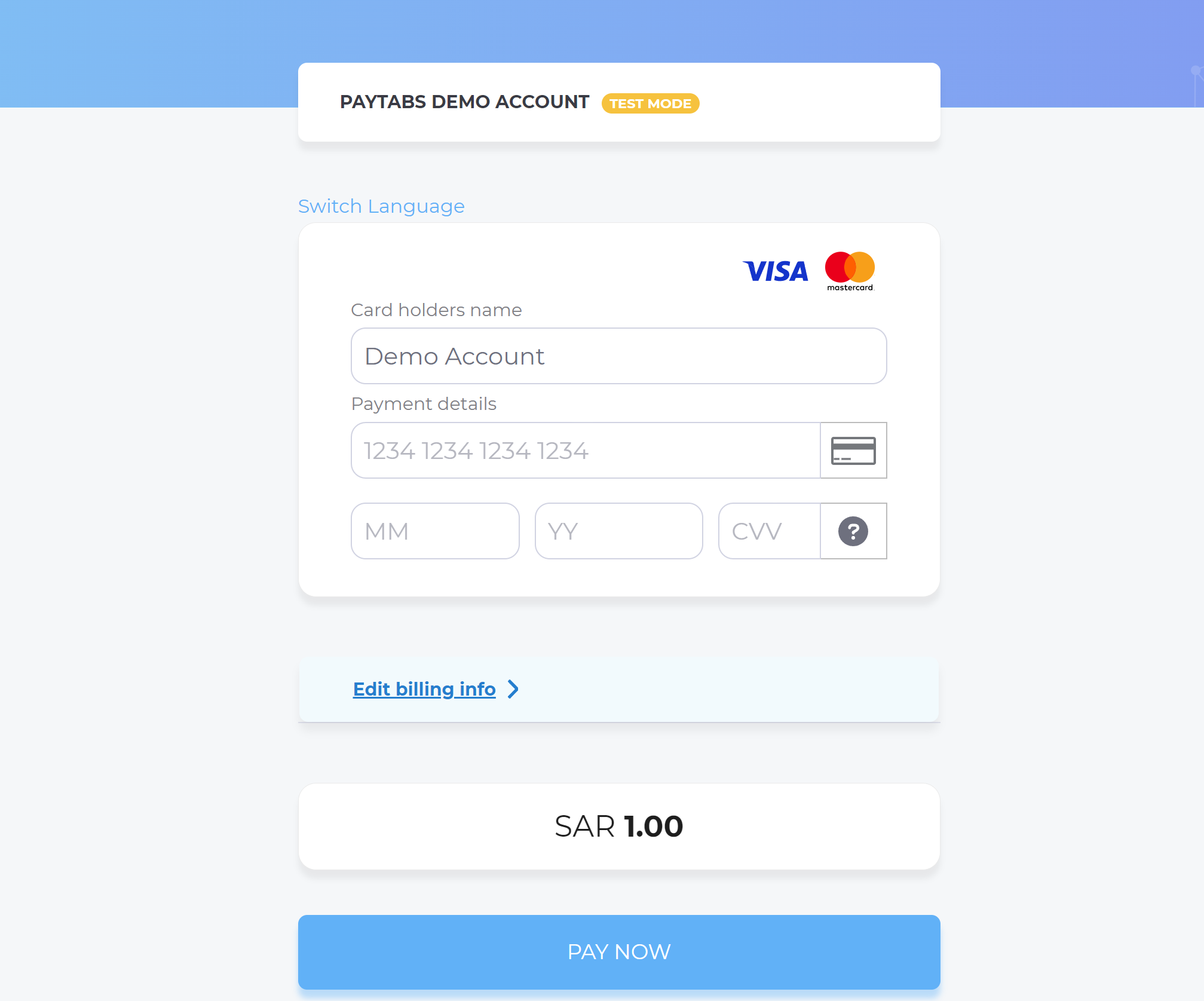

- Then, after generating the payment page use the result to redirect the customer to the payment page.

function callbackMethod(result) {

//failed to create the payment page.

if (result['response_code:'] === 400) {

// get the message

console.log(result['result']);

// Next step

}

//success to create the payment page.

else {

//On success, redirect the customer to complete the payment.

console.log(result.redirect_url);

// Next step

};

}

PayTabs.createPaymentPage(

paymentMethods,

transaction_details,

cart_details,

customer_details,

shipping_address,

response_URLs,

lang,

callbackMethod,

frameMode

); - After this, your customer would proceed normally with payment by choosing the preferred payment method (if available), and providing his card information.

- Then, he will be redirected to his issuer bank 3DS/OTP page to authenticate the used card

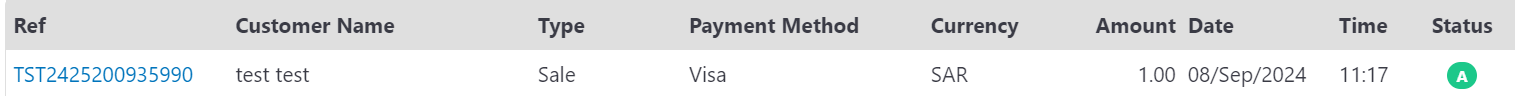

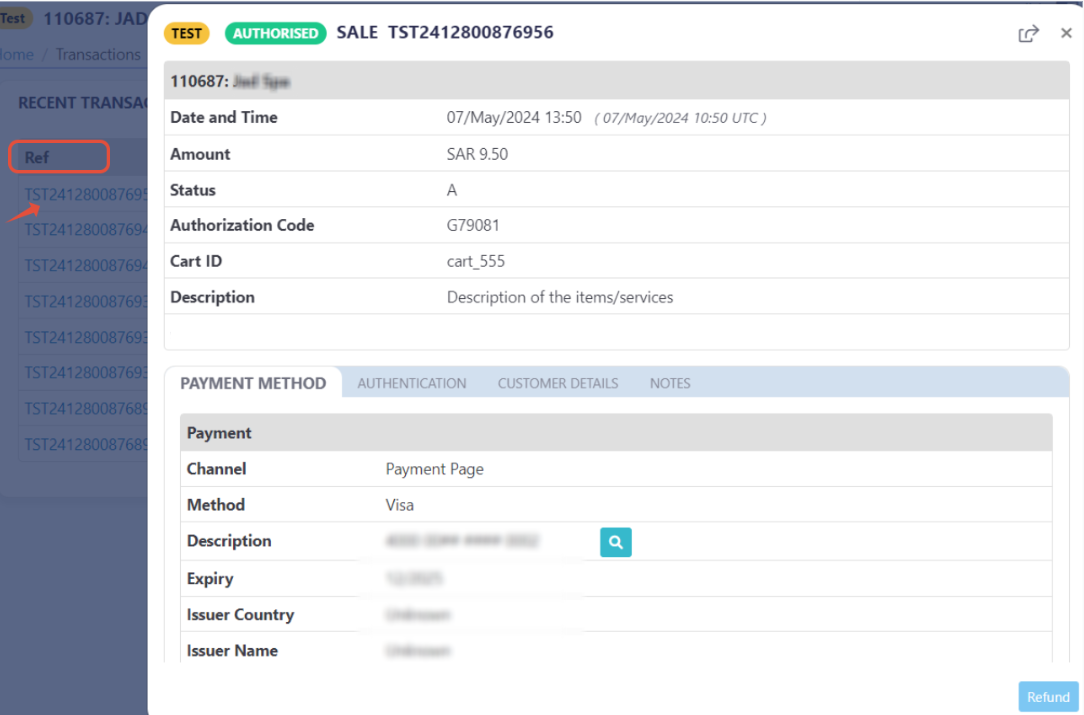

- Finally, he would be redirect to a success/error page accordingly. By this time, you will be able to see his transaction on your merchant dashboard, whether it's accepted/authorized or not.