Request/Response: Alternative Currency (alt_currency)

This parameter ONLY working with those integration types (Hosted Payment Page, Invoices(Payment Endpoint)).

PayTabs provides merchants with the ability to enhance their payment processing by incorporating an alternative currency option. This feature allows merchants to display transaction amounts in a currency other than the primary one used for payment.

By offering an alternative currency, merchants can cater to a broader audience, making it easier for international customers to understand the cost of their purchases. This can lead to improved customer satisfaction and potentially higher conversion rates.

The flexibility of this feature means that merchants can set it up to display the alternative currency amount on their payment pages, providing transparency and clarity during the checkout process.

How this parameter could benefit you?

Implementing the alt_currency parameter can thus provide a more tailored and efficient payment experience, benefiting both your business operations and customer satisfaction.

- Travel and Tourism: Businesses in the travel sector can show prices in the local currency of the destination, helping travelers gauge expenses more accurately.

- E-commerce Platforms: Online stores selling to global markets can use the alternative currency feature to enhance user experience by displaying prices in the customer’s preferred currency.

- Subscription Services: Subscription-based businesses can offer pricing in various currencies to accommodate international subscribers, improving conversion rates.

- Promotional Campaigns: During special promotions targeting specific regions, merchants can display prices in the local currency to attract more customers.

- Market Expansion: When entering new markets, merchants can use the alternative currency feature to build trust and familiarity with local customers.

- Encourages Larger Payments: By setting a minimum and maximum range, you can subtly encourage customers to pay more than the minimum, potentially increasing your revenue.

Limitations

- Exchange Rate Fluctuations:The value of the alternative currency may vary, leading to discrepancies in the displayed amount versus the actual charge.

- User Experience Challenges:If not clearly communicated, displaying multiple currencies could confuse customers, potentially leading to abandoned carts.

- Display Only: The alternative currency is solely for display purposes and does not impact the settlement currency. Transactions will be processed in the primary currency as reflected in your dashboard.

How to Use?

In order for you to start use the alt_currency feature, you kindly need to follow the below simple steps:

- Within the initiation of the request payload of the payment page/link in Step 3 via any of the supported integration types by this feature, you will use the optional parameter

alt_currencywithin the main request payload itself as shown below:{

.

"alt_currency":"USD",

.

} - Once you post your request, you will receive a response that includes redirect URL like the following:

"redirect_url": "https://secure.paytabs.com/payment/page/599458B182E5B6B********************B4818688", - Finally you will need navigate/redirect your customer to the the previous mentioned link as this is crucial for your customer to proceed through the payment process. You may need to check his customer experience after in the coming Expected Payment Flow Behavior.

Parameter Specifications

-

alt_currencyParameter alt_currencyDescription Indicates an alternative currency that you want to display your amount with it in your payment page. This will allow you to display the approximate amount of the payment cart amount in this alternative currency for this transaction.. Data Type STRING Required ✘ Min 3 Characters Max 3 Characters Validation Rules - Valid and Supported currency code

- Accepts both upper- and lower-case characters

Sample {

"alt_currency ":"SAR"

}

Request & Response Payloads Samples

- Hosted Payment Page

- Invoices

The below sample request payload will show you how you can pass the above-mentioned required parameter/s, which are needed to be passed with valid values to perform a request. Along with the response payload received after using this request payload.

- Request Sample Payload

- Response Sample Payload

{

"profile_id": {{profile_id}},

"tran_type": "sale",

"tran_class": "ecom",

"cart_description": "Description of the items/services",

"cart_id": "Unique order reference00",

"cart_amount": 25000.2,

"cart_currency": "SAR",

"alt_currency":"USD

}

{

"tran_ref": "TST22********159",

"tran_type": "Sale",

"cart_id": "CART#1001",

"cart_description": "Description of the items/services",

"cart_currency": "SAR",

"cart_amount": "500.00",

"return": "none",

"redirect_url": "https://secure.paytabs.com/payment/page/599458B182E5B6B********************B4817FD44318539688688",

"serviceId": 2,

"profileId": 9*****4,

"merchantId": 1*****7,

"trace": "PMN****4.63****A8.00****C4"

}

The below sample request payload will show you how you can pass the above-mentioned required parameter/s, which are needed to be passed with valid values to perform a request. Along with the response payload received after using this request payload.

- Request Sample Payload

- Response Sample Payload

{

"profile_id": {{profile_id}},

"tran_type": "sale",

"tran_class": "ecom",

"cart_currency": SAR,

"cart_amount": "9.5",

"cart_id": "cart_12345_2",

"cart_description": "Test Description",

"hide_shipping": true,

"alt_currency":"USD

"invoice": {

"line_items": [

{

"unit_cost": 9.5,

"quantity": 1,

}

]

}

}

{

"tran_ref": "TST22********159",

"tran_type": "Sale",

"cart_id": "CART#1001",

"cart_description": "Description of the items/services",

"cart_currency": "SAR",

"cart_amount": "9.5",

"return": "none",

"redirect_url": "https://secure.paytabs.com/payment/page/599458B182E5B6B********************B4817FD44318539688688",

"serviceId": 2,

"profileId": 9*****4,

"merchantId": 1*****7,

"trace": "PMN****4.63****A8.00****C4"

}

Expected Payment Flow Behavior

- Hosted Payment Page

- Invoices

- As mentioned above in the How to use? section, As a merchant you would initiate a payment request per the above Specifications, same as the sample codes mentioned in the samples section above.

- Then, you will receive a response that includes redirect URL. This means you have initiated a correct payment request/page successfully.

"redirect_url": "https://secure.paytabs.com/payment/page/599458B182E5B6B********************B4818688", - Next, you should redirect your customer to this URL so the payment process can be finalized.

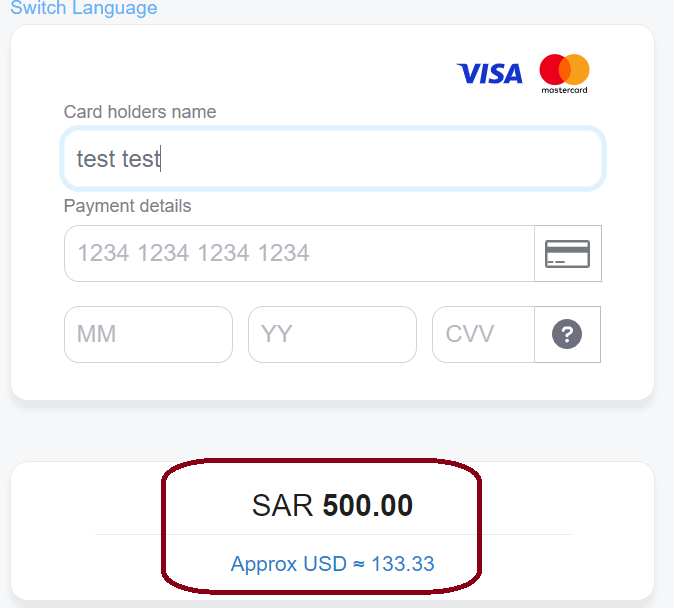

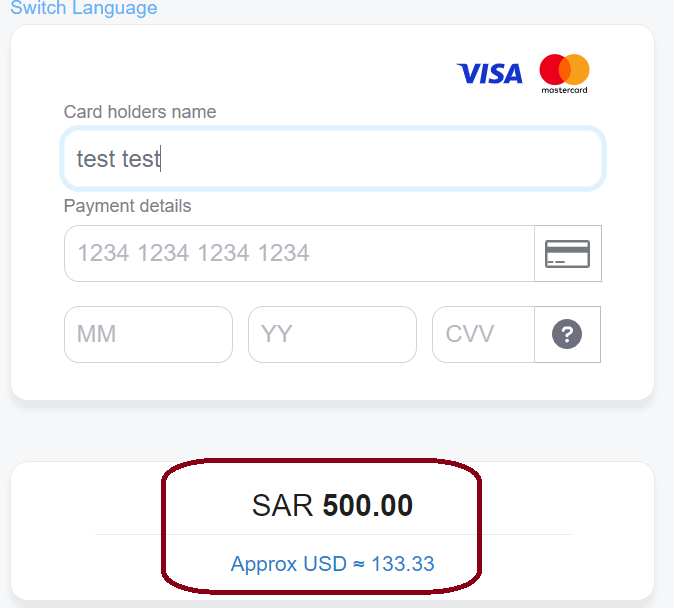

- After this, your customer would proceed normally with payment by providing his card information, and he will be able to see both the original and the alternative currency as shown below:

- Then, he will be redirected to his issuer bank 3DS/OTP page to authenticate the used card

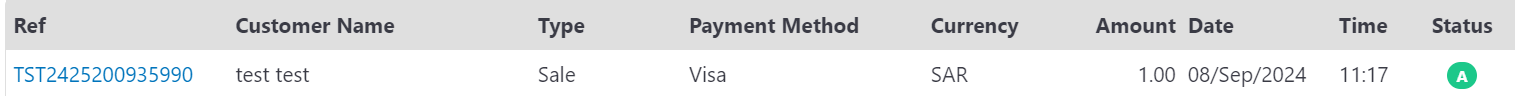

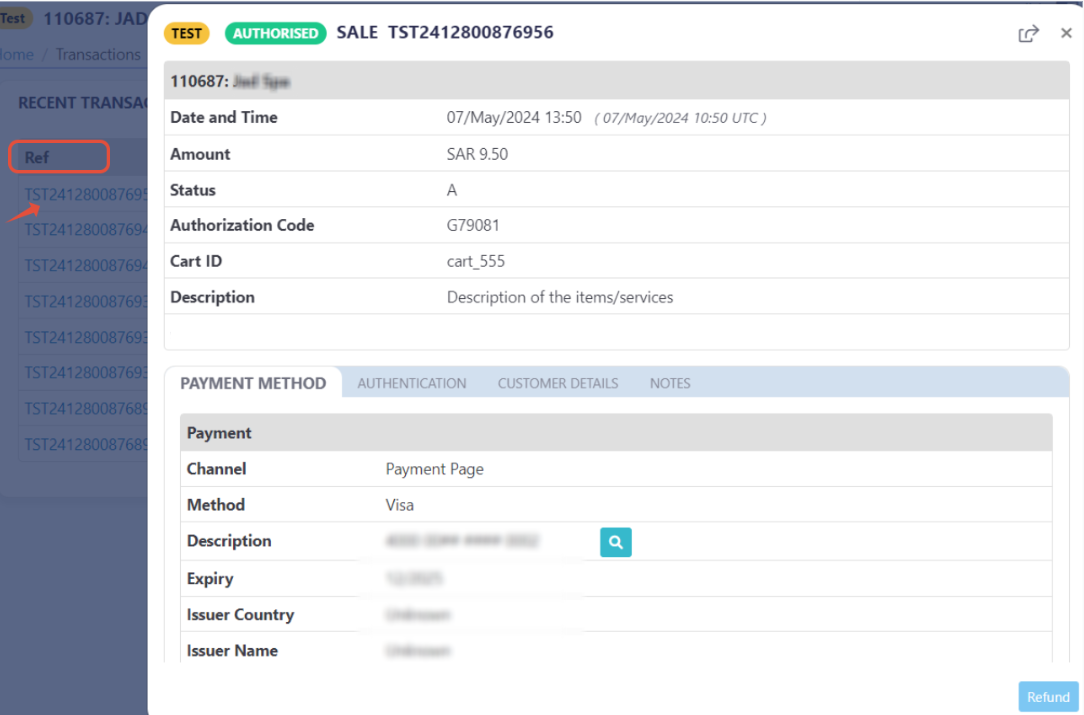

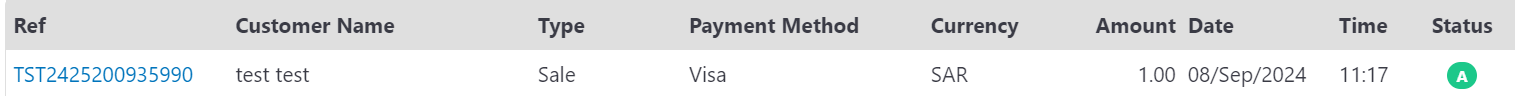

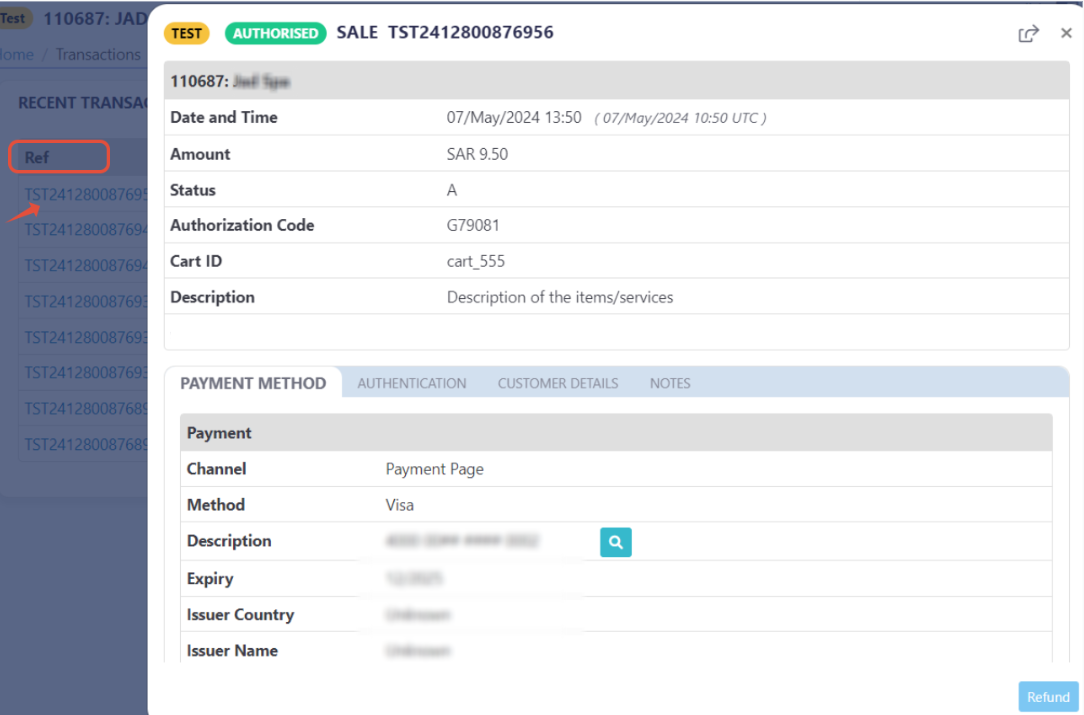

- Finally, he would be redirect to a success/error page accordingly. By this time, you will be able to see his transaction on your merchant dashboard, whether it's accepted/authorized or not.

- As mentioned above in the How to use? section, As a merchant you would initiate a payment request per the above Specifications, same as the sample codes mentioned in the samples section above.

- Then, you will receive a response that includes redirect URL. This means you have initiated a correct payment request/page successfully.

"redirect_url": "https://secure.paytabs.com/payment/page/599458B182E5B6B********************B4818688", - Next, you should redirect your customer to this URL so the payment process can be finalized.

- After this, your customer would proceed normally with payment by providing his card information, and he will be able to see both the original and the alternative currency as shown below:

- Then, he will be redirected to his issuer bank 3DS/OTP page to authenticate the used card

- Finally, he would be redirect to a success/error page accordingly. By this time, you will be able to see his transaction on your merchant dashboard, whether it's accepted/authorized or not.