Request/Response: Cart Currency (cart_currency)

This parameter behaving the same regardless of the integration type you are using.

n the evolving landscape of online payments, precision and global compatibility are crucial. PayTabs introduces the required cart_currency parameter, designed to enhance the transaction experience for users. This feature allows merchants to specify the currency in which the transaction will be processed, ensuring a seamless and accurate payment process.

Instead of processing transactions with ambiguous currency details, the cart_currency parameter enables merchants to define the exact currency for each transaction. This clarity helps in maintaining accurate records, reducing errors, and providing a seamless payment experience.

By understanding the key parameters such as cart_currency, businesses can effectively integrate this feature to cater to their operational needs and enhance the customer experience.

How this parameter could benefit you?

The cart_currency parameter is essential for ensuring a smooth and organized transaction process. Here’s how it can benefit you:

- Global Compatibility: By specifying the currency for each transaction, the

cart_currencyparameter allows you to cater to international customers, enhancing your global reach and customer satisfaction. - Clear Financial Records: The

cart_currencyparameter helps maintain clear and organized financial records by accurately reflecting the currency used in each transaction. This is crucial for accounting and auditing purposes. - Enhanced Customer Experience: Providing a clear and accurate currency for transactions enhances the overall customer experience, as customers can see the exact amount they will be charged in their local currency.

- Simplified Reporting and Analysis: The

cart_currencyparameter enables detailed reporting and analysis of sales data across different currencies. This helps you understand your sales performance in various markets and make informed business decisions. - Compliance with Regulations: Ensuring that transactions are processed in the correct currency helps maintain compliance with financial regulations and standards, reducing the risk of legal issues.

Name but a few different Businesses/Industries that can benefit from this API parameter:

- E-commerce Platforms: Online retailers can use the

cart_currencyparameter to cater to international customers by allowing transactions in multiple currencies, enhancing the shopping experience and expanding their global reach. - Subscription Services: Companies offering subscription-based models, such as streaming services or software providers, can benefit by using the

cart_currencyto manage recurring charges in the customer's preferred currency, ensuring accurate and consistent billing. - Travel and Hospitality: Travel agencies, airlines, and hotels can specify the currency for bookings, making it easier to manage international reservations and providing a seamless experience for travelers.

- Healthcare Providers: Clinics and hospitals can use the

cart_currencyto track payments for different services, such as consultations, treatments, and diagnostics, ensuring accurate billing for international patients. - Education Institutions: Schools and universities can benefit by using the

cart_currencyto manage payments for tuition, course materials, and other fees, providing a clear and organized payment process for international students. - Event Management Companies: Event organizers can specify the currency for ticket sales, sponsorships, and merchandise, ensuring a smooth and organized payment process for attendees from different countries.

- Non-Profit Organizations: Charities and non-profits can use the

cart_currencyto manage donations, event registrations, and other transactions, making it easier to track and manage contributions from international donors.

Limitations

- Mandatory Inclusion: This parameter must be included in every payment creation request. Omitting this parameter will result in the failure of the request.

- Duplicate Request Error: If the same details (

cart_currency,cart_amount,cart_id,profile_id) are duplicated within less than 2 minutes, it will cause a duplicate request error. This is a safeguard to prevent accidental double charges or duplicate transactions. - Profile-Specific Configuration: The types of currencies available are limited to those configured in the merchant's profile. If a specific currency is not set up in your profile, it cannot be used for transactions.

- Acquirer Bank Support: Not all currencies are supported by every acquiring bank. Some banks may have restrictions on certain currencies, which could require special agreements or additional documentation. It's important to verify with your acquiring bank which currencies are supported.

- Regulatory Compliance: Certain currencies may be subject to regulatory restrictions or requirements, depending on the region or industry. Compliance with these regulations is essential to avoid legal issues.

How to Use?

In order for you to start use thecart_currency parameter, you kindly need to follow the below simple steps:- Within the initiation of the request payload of the payment page as mentioned in Step 3 via regardless the integration types, you will MUST use the mandatory parameter

cart_currencywithin the main request payload itself as shown below. You need also to ensure that all required parameters are included and correctly formatted.You Should Be Aware OfIt is not necessary for customers to pay with a card or bank account that matches the

cart_currency. Thecart_currencyparameter defines the currency in which the transaction will be settled. The customer's issuing bank will handle any necessary currency conversion at the applicable exchange rate. This ensures that customers can make payments in their preferred currency, while the transaction is processed in the specifiedcart_currency.{

...

"cart_currency": "SAR",

....

} - Once you post your request, you will receive a response that includes the

cart_currencyas well:WarningOnly in "Invoices" integration type (via the invoice endpoint), you will NOT receive the

cart_currencyin the response, as mentioned in theInvoices - Step 3 | Initiate the payment manual.{

...

"cart_currency": "SAR",

....

} - Depending on the integration type and the request, not within all the payments life cycle, you will will need to redirect the customer to the payment page or any other external links for either authenticate the cardholder via the 3D Secure or other needed actions.

You may need to check his customer experience after in the coming Expected Payment Flow Behavior.

Parameter Specifications

-

cart_currencyParameter cart_currencyDescription Indicates the transaction currency, which the customer will be charged with.

To know more about this parameter please click here.Data Type STRING Required ✔ Min 1 Max 128 Validation Rules Valid string from the following list: SARAEDBHDEGPEURGBPHKDIDRINRIQDJODJPYKWDMADOMRPKRQARUSD

Accepts both upper/lower case charactersSample {

"cart_currency": "SAR"

}

Request & Response Payloads Samples

- Hosted Payment Page

- Invoices

- PayLinks

- Managed Form

- Own Form

The below sample request payload will show you how you can pass the above-mentioned required parameter, which are needed to be passed with valid values to perform a request. Along with the response payload received after using this request payload.

- Request Sample Payload

- Response Sample Payload

{

"profile_id": "SAR",

"tran_type": "sale",

"tran_class": "ecom",

"cart_id": "cart_1",

"cart_currency": "SAR",

"cart_amount": 12.3,

"cart_description": "Description of the items/services",

"paypage_lang": "en",

"customer_details": {

"name": "FirstName LastName",

"email": "[email protected]",

"phone": "9771555555555",

"street1": "street2",

"city": "dubai",

"state": "dubai",

"country": "AE",

"zip": "54321"

},

"shipping_details": {

"name": "FirstName LastName",

"email": "[email protected]",

"phone": "971555555555",

"street1": "street2",

"city": "dubai",

"state": "dubai",

"country": "AE",

"zip": "54321"

}

}

{

"tran_ref": "TST22********159",

"tran_type": "sale",

"cart_id": "cart_1",

"cart_description": "Description of the items/services",

"cart_currency": "SAR",

"cart_amount": "12.30",

"tran_total": "0",

"return": "none",

"redirect_url": "https://secure.paytabs.com/payment/wr/5DBXXX4F5BB9C2EXXXX8249E75E3D4D8C84",

"customer_details": {

"name": "FirstName LastName",

"email": "[email protected]",

"phone": "971555555555",

"street1": "street2",

"city": "dubai",

"state": "dubai",

"country": "AE",

"zip": "54321"

},

"shipping_details": {

"name": "FirstName LastName",

"email": "[email protected]",

"phone": "971555555555",

"street1": "street2",

"city": "dubai",

"state": "dubai",

"country": "AE",

"zip": "54321"

},

"serviceId": 2,

"profileId": 79010,

"merchantId": 43796,

"trace": "PMN****4.63****A8.00****C4"

}

The below sample request payload will show you how you can pass the above-mentioned required parameter, which are needed to be passed with valid values to perform a request. Along with the response payload received after using this request payload.

Only in "Invoices" integration type (via the invoice endpoint), you will NOT receive the tran_type in the response, as mentioned in theInvoices - Step 3 | Initiate the payment manual.

- Request Sample Payload

- Response Sample Payload

{

"profile_id": "SAR",

"tran_type": "sale",

"tran_class": "ecom",

"cart_description": "Description of the items/services",

"cart_id": "Unique order reference00",

"cart_amount": 200,

"cart_currency": "SAR",

"invoice": {

"line_items": [

{

"unit_cost": 100,

"quantity":2

}

]

}

}

{

"tran_ref": "TST22********159",

"tran_type": "Sale",

"cart_id": "Unique order reference00",

"cart_description": "Description of the items/services",

"cart_currency": "SAR",

"cart_amount": "200.00",

"tran_total": "0",

"return": "none",

"redirect_url": "https://secure.paytabs.com/payment/wr/5DB410*******9762FE9DBA2",

"invoice": {

"id": 3123814,

"shipping_charges": "0",

"extra_charges": "0",

"extra_discount": "0",

"total": "200",

"activation_date": 0,

"expiry_date": 0,

"due_date": 0,

"issue_date": 1732761054,

"line_items": [

{

"unit_cost": "100",

"quantity": "2",

"net_total": "200",

"discount_rate": "0",

"discount_amount": "0",

"tax_rate": "0",

"tax_total": "0",

"total": "200"

}

]

},

"serviceId": 2,

"profileId": 79010,

"merchantId": 28882,

"trace": "PMN****4.63****A8.00****C4"

}

The below sample request payload will show you how you can pass the above-mentioned required parameter, which are needed to be passed with valid values to perform a request. Along with the response payload received after using this request payload.

- Request Sample Payload

- Response Sample Payload

{

"profile_id": "79010",

"link_title": "AK-Test Title",

"cart_currency": "400",

"cart_currency": "SAR"

}

{

"link_id": "147XXX",

"profile_id": "79010",

"link_url": "https://secure.paytabs.com/payment/link/109XXX/1474XXX",

"link_title": "AK-Test Title",

"cart_currency": "SAR",

"cart_currency": "400",

"cart_min": "0",

"cart_max": "0",

"shipping_required": false,

"link_status": true,

"donation_mode": false,

"created_at": "2024-10-02T09:39:41Z",

"updated_at": "2024-10-02T09:39:41Z"

}

The below sample request payload will show you how you can pass the above-mentioned required parameter, which are needed to be passed with valid values to perform a request. Along with the response payload received after using this request payload.

- Request Sample Payload

- Response Sample Payload

{

"profile_id": "SAR",

"tran_type": "sale",

"tran_class": "ecom",

"cart_id": "CART#1001",

"cart_currency": "SAR",

"cart_amount": 9.5,

"cart_description": "Description of the items/services",

"customer_details":

{

"name": "FirstName LastName",

"email": "[email protected]",

"phone": "971555555555",

"street1": "street2",

"city": "dubai",

"state": "dubai",

"country": "AE",

"zip": "54321"

},

"payment_token": "Dh4r8Jw*******zKgtk"

}

{

"tran_ref": "TST22********159",

"tran_type": "Sale",

"cart_id": "CART#1001",

"cart_description": "Description of the items/services",

"cart_currency": "SAR",

"cart_amount": "9.5",

"return": "none",

"redirect_url": "https://secure.paytabs.com/payment/page/599458B6B********B4817F688688",

"serviceId": 2,

"profileId": 79010,

"merchantId": 28882,

"trace": "PMN****4.63****A8.00****C4"

}

The below sample request payload will show you how you can pass the above-mentioned required parameter, which are needed to be passed with valid values to perform a request. Along with the response payload received after using this request payload.

- Request Sample Payload

- Response Sample Payload

{

"profile_id": "9xxx4",

"tran_type": "sale",

"tran_class": "ecom",

"cart_id": "CART#1001",

"cart_currency": "SAR",

"cart_amount": 9.5,

"cart_description": "Description of the items/services",

"customer_details":

{

"name": "Technical Support Team",

"email": "[email protected]",

"phone": "+201234567890",

"street1": "address street",

"city": "Cairo",

"state": "CAI",

"country": "EG",

"zip": "45555",

"ip": "1.1.1.1"

},

"card_details": {

"pan": "4111111111111111",

"cvv": "123",

"expiry_month": 12,

"expiry_year": 2023

}

}

{

"tran_ref": "TST22********159",

"tran_type": "Sale",

"cart_id": "CART#1001",

"cart_description": "Description of the items/services",

"cart_currency": "SAR",

"cart_amount": "9.5",

"return": "none",

"redirect_url": "https://secure.paytabs.com/payment/page/599458B6B********B4817F688688",

"customer_details":

{

"name": "Technical Support Team",

"email": "[email protected]",

"phone": "+201234567890",

"street1": "address street",

"city": "Cairo",

"state": "CAI",

"country": "EG",

"zip": "45555",

"ip": "1.1.1.1"

},

"serviceId": 2,

"profileId": 79010,

"merchantId": 28882,

"trace": "PMN****4.63****A8.00****C4"

}

Expected Payment Flow Behavior

- Hosted Payment Page

- Invoices

- PayLinks

- Managed Form

- Own Form

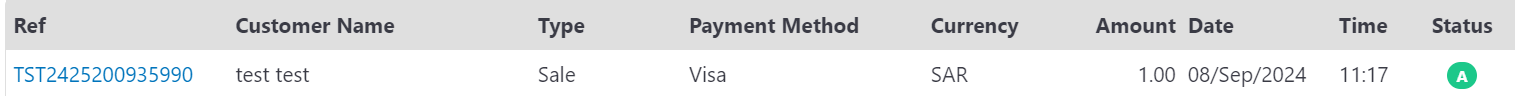

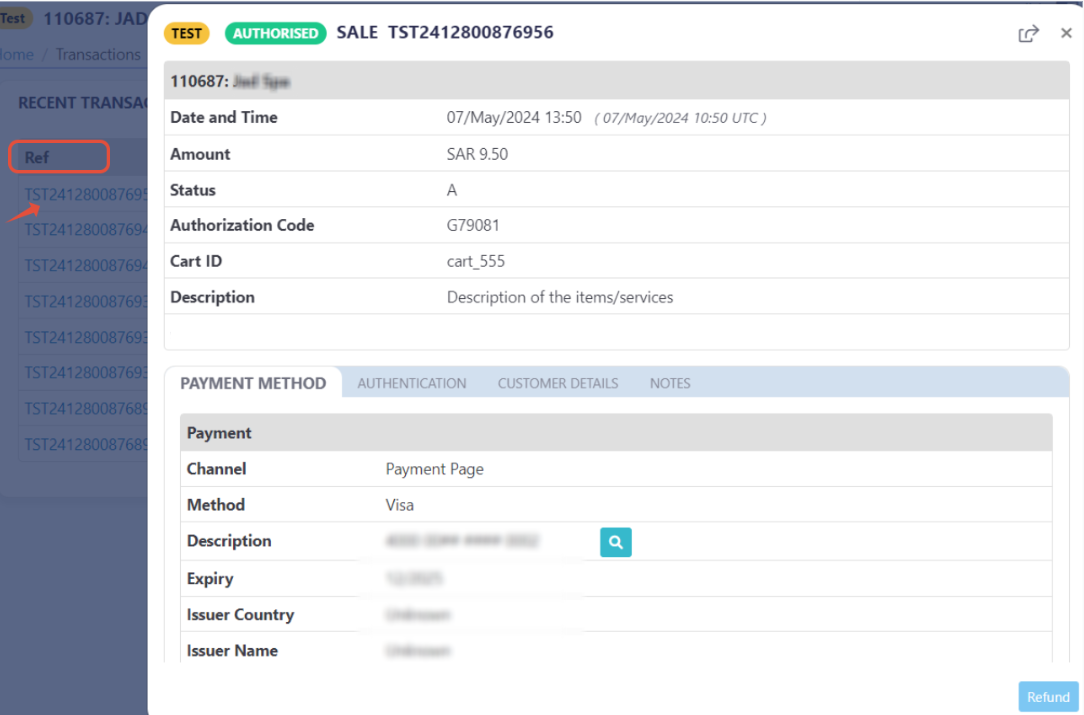

- As mentioned above in the How to use? section, As a merchant you would initiate a payment request per the above Specifications, same as the sample codes mentioned in the samples section above.

- Then, you will receive a response that includes the same

cart_currencyyou passed in the request payload, along with the redirect URL. This means you have initiated a correct payment request/page successfully.{

"cart_currency": "SAR",

.

.

"redirect_url": "https://secure.paytabs.com/payment/page/52E5B6B*************B4818688",

.

.

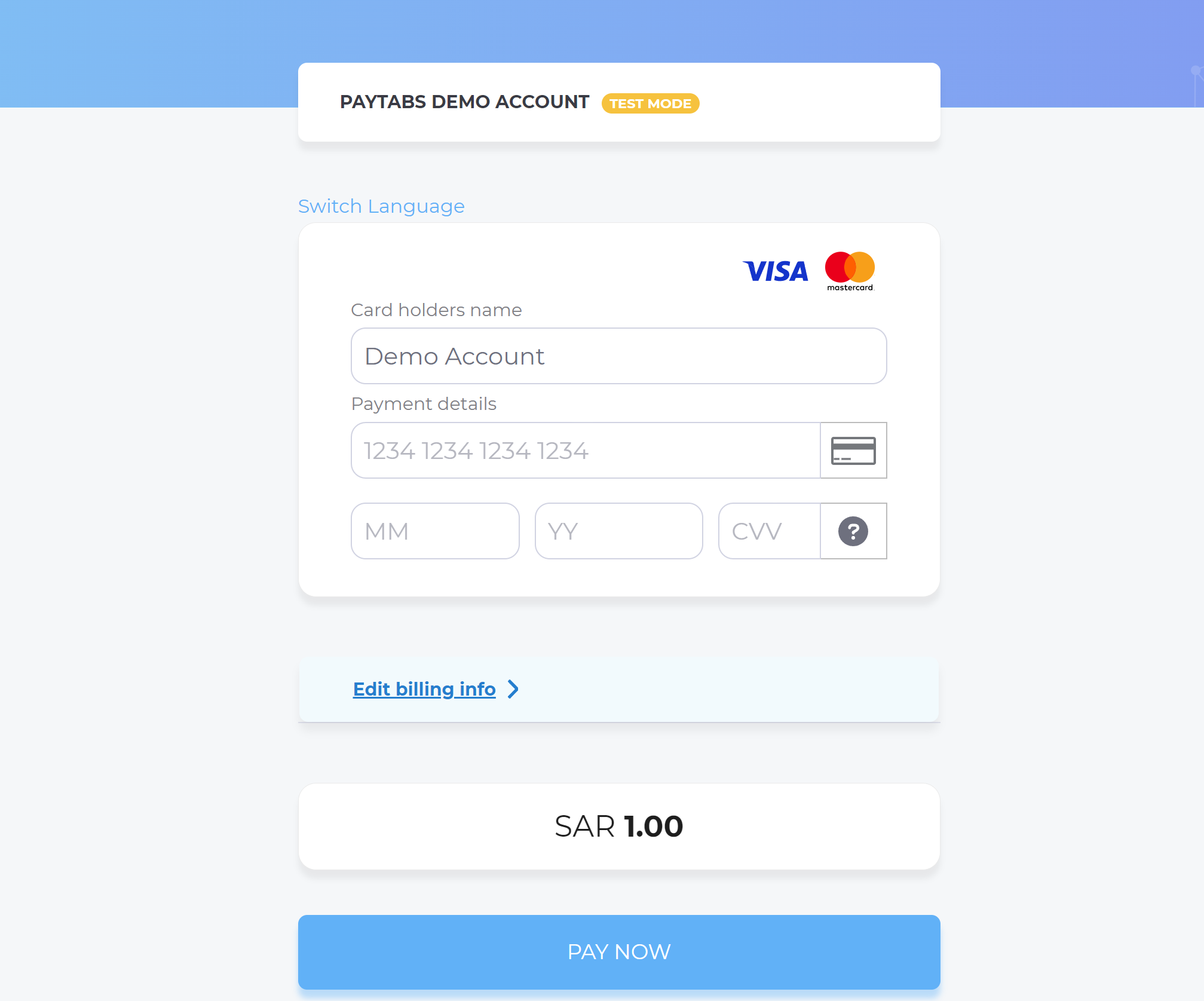

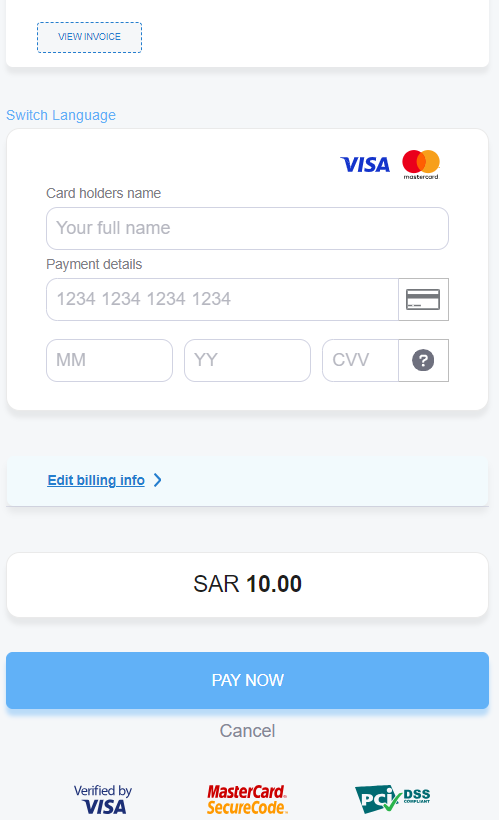

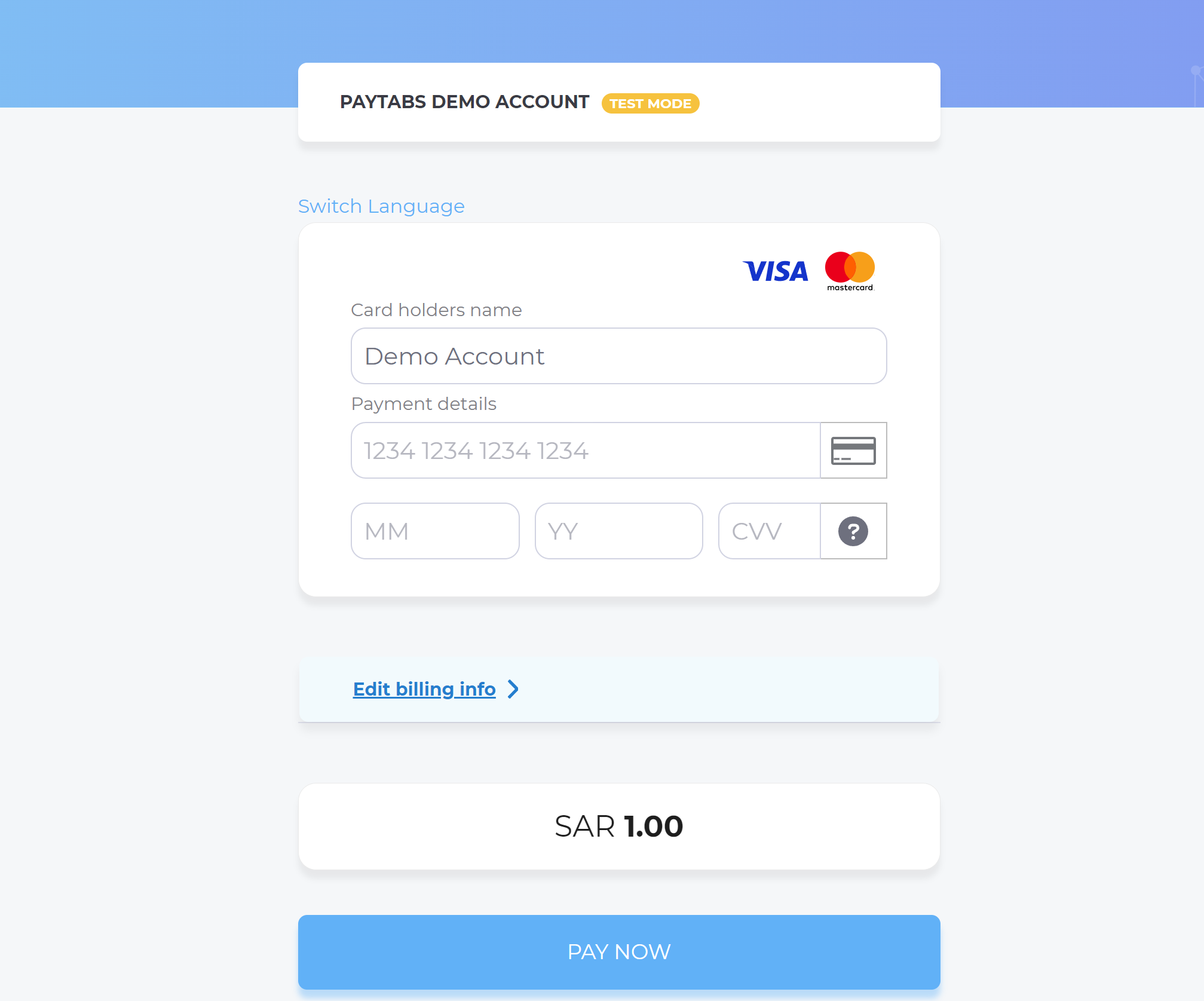

} - Next, you should redirect your customer to this URL so the payment process can be finalized.

- After this, your customer would proceed normally with payment by choosing the preferred payment method (if available), and providing his card information.You Should Be Aware Of

It is not necessary for customers to pay with a card or bank account that matches the

cart_currency. Thecart_currencyparameter defines the currency in which the transaction will be settled. The customer's issuing bank will handle any necessary currency conversion at the applicable exchange rate. This ensures that customers can make payments in their preferred currency, while the transaction is processed in the specifiedcart_currency.

- Then, he will be redirected to his issuer bank 3DS/OTP page to authenticate the used card

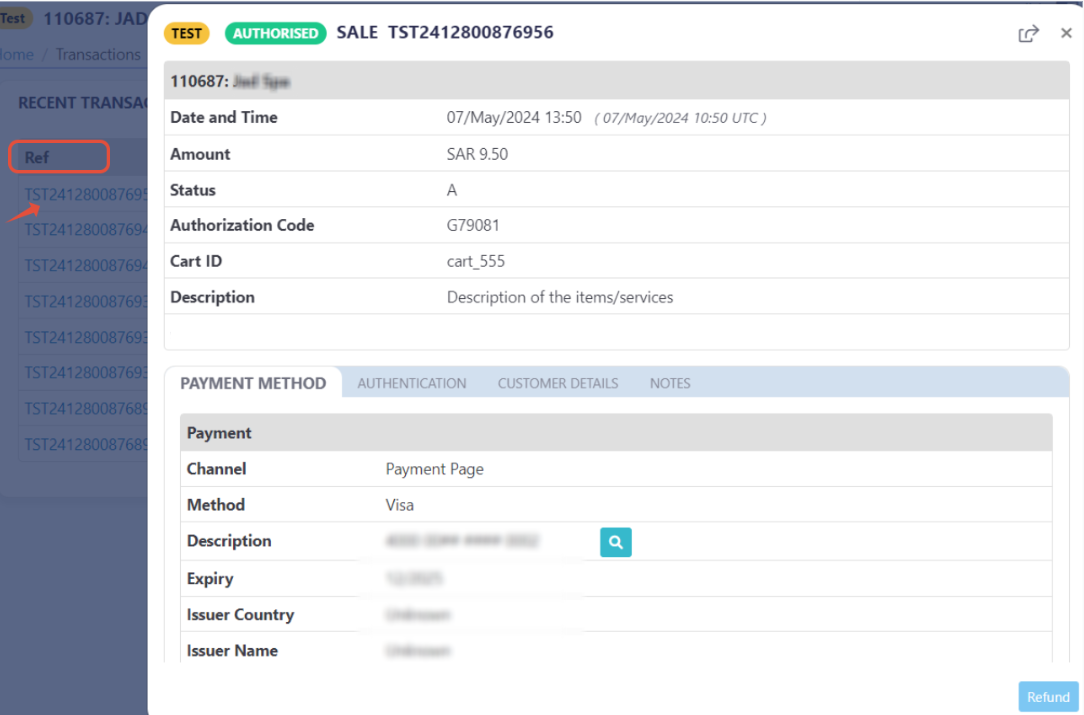

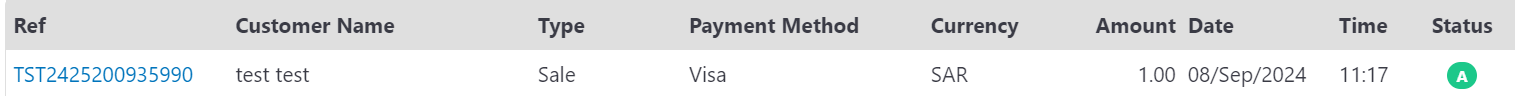

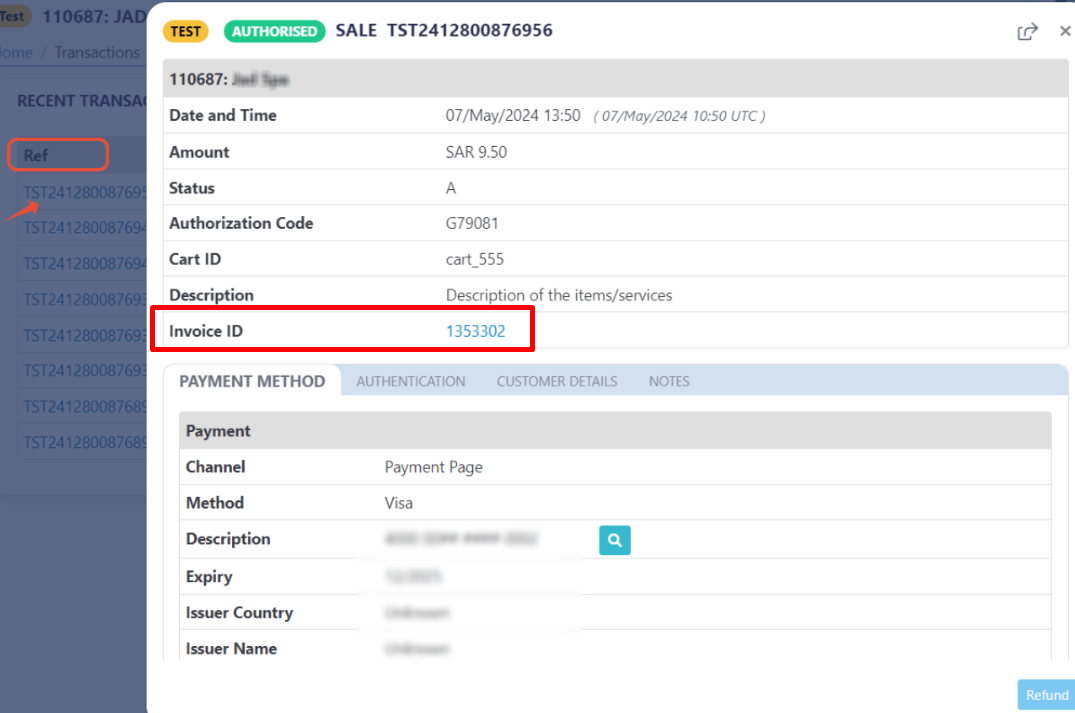

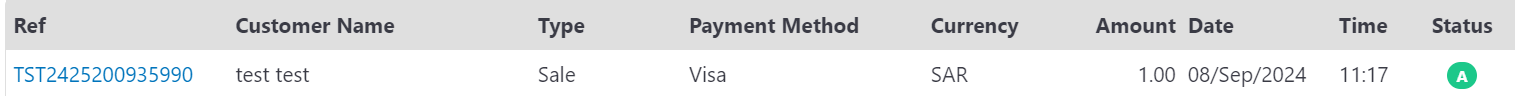

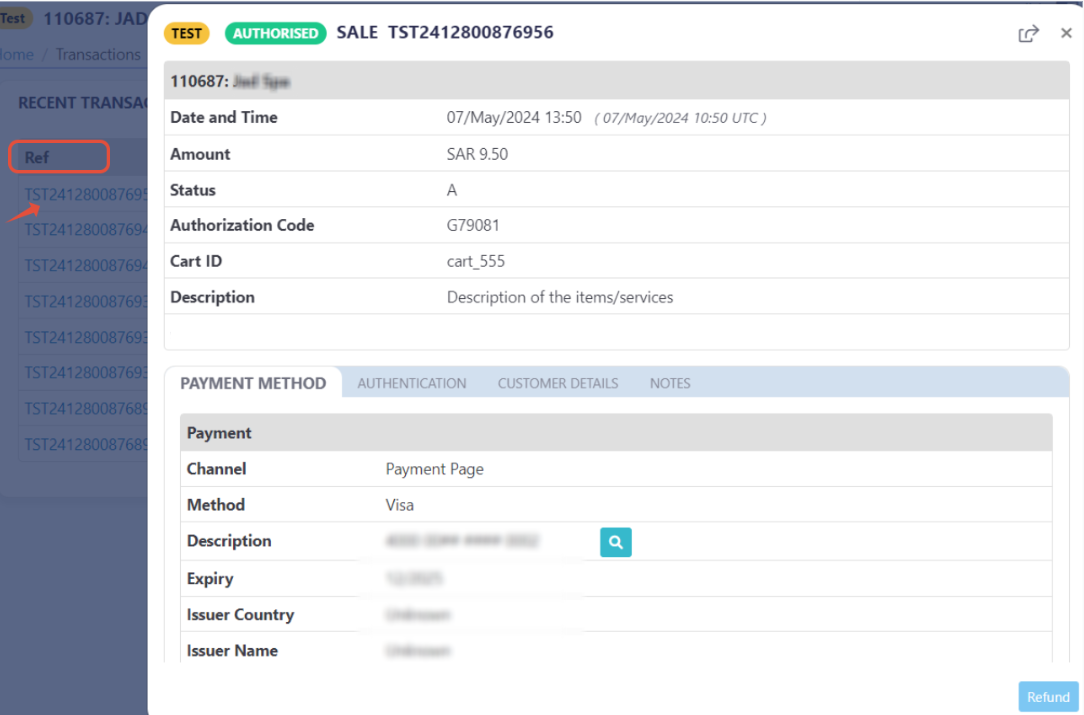

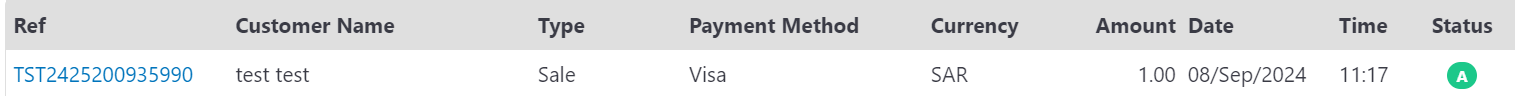

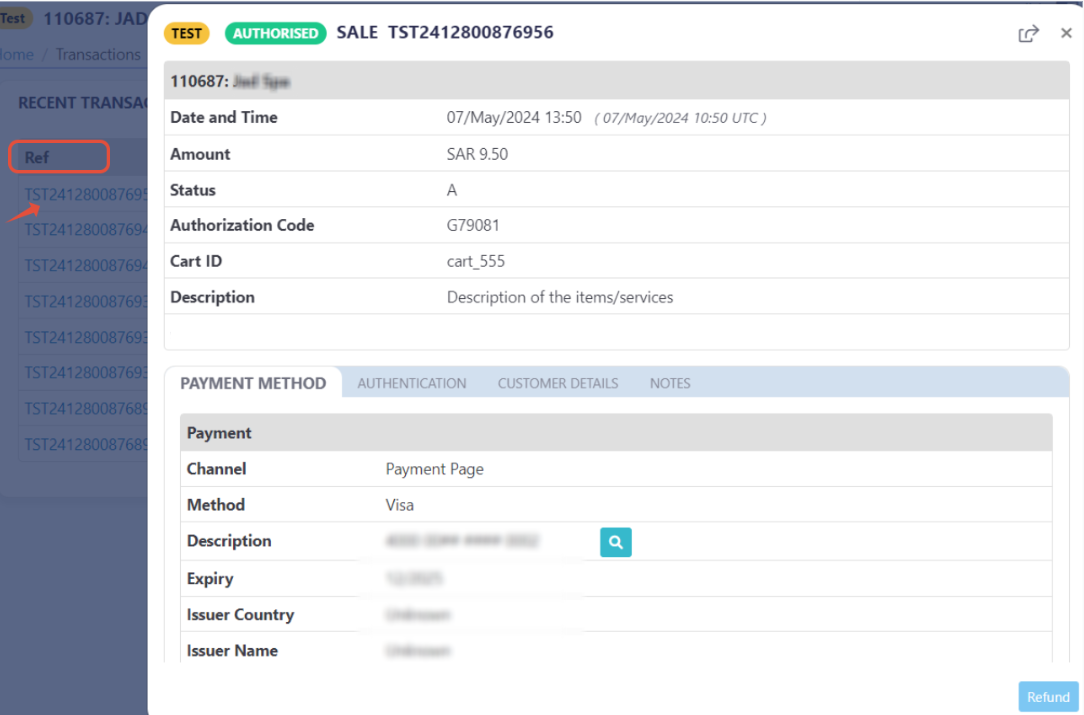

- Finally, he would be redirect to a success/error page accordingly. By this time, you will be able to see his transaction on your merchant dashboard, whether it's accepted/authorized or not.Warning

If the transaction

cart_currencyfalls outside the "Transaction Amount Limit" set in the merchant's account, which defines the maximum and minimum amounts that can be processed in a single transaction, it will result in a transaction failure.

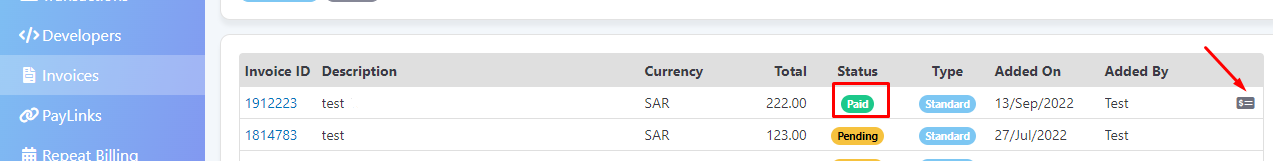

- As mentioned above in the How to use? section, As a merchant you would initiate a payment request per the above Specifications, same as the sample codes mentioned in the samples section above.

- Then, you will receive a response that includes the same

cart_currencyyou passed in the request payload, along with the redirect URL. This means you have initiated the invoice successfully.WarningOnly in "Invoices" integration type (via the invoice endpoint), you will NOT receive the

cart_currencyin the response, as mentioned in theInvoices - Step 3 | Initiate the payment manual.{

"cart_currency": "SAR",

.

.

"redirect_url": "https://secure.paytabs.com/payment/page/52E5B6B*************B4818688",

.

.

} - In the meantime, your invoice would be already created on your dashboard, which you can access from your merchant dashboard.

- After this, your customer would proceed normally with payment by providing his card information.You Should Be Aware Of

It is not necessary for customers to pay with a card or bank account that matches the

cart_currency. Thecart_currencyparameter defines the currency in which the transaction will be settled. The customer's issuing bank will handle any necessary currency conversion at the applicable exchange rate. This ensures that customers can make payments in their preferred currency, while the transaction is processed in the specifiedcart_currency.

- Then, he will be redirected to his issuer bank 3DS/OTP page to authenticate the used card

- Finally, he would be redirect to a success/error page accordingly. By this time, you will be able to see his transaction on your merchant dashboard, whether it's accepted/authorized or not. Only successful payments will be connected to the invoice itself in the invoice record.Warning

If the transaction

cart_currencyfalls outside the "Transaction Amount Limit" set in the merchant's account, which defines the maximum and minimum amounts that can be processed in a single transaction, it will result in a transaction failure.

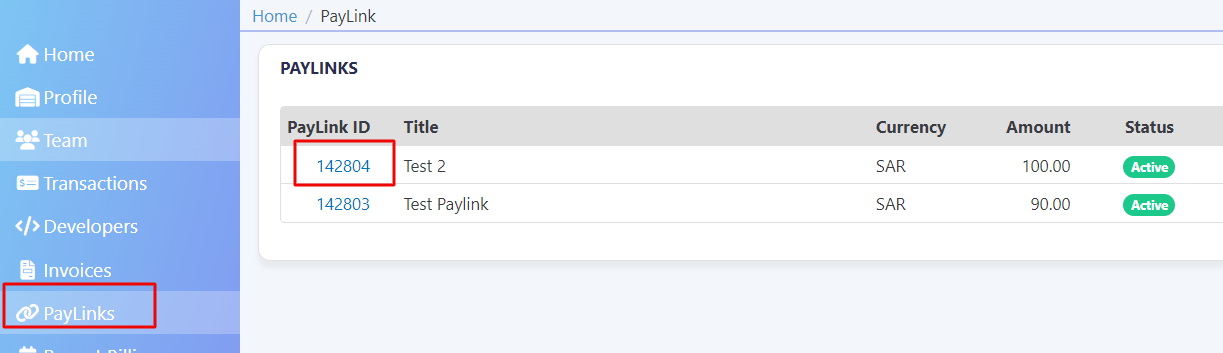

- As mentioned above in the How to use? section, As a merchant you would initiate a payment request per the above Specifications, same as the sample codes mentioned in the samples section above.

- Then, you will receive a response that includes the same

cart_currencyyou passed in the request payload, along with the redirect URL. This means you have initiated the payment link successfully.{

"cart_currency": "SAR",

.

.

"link_url": "https://secure.paytabs.com/payment/link/109430/1474XX7",

.

.

} - In the meantime, your PayLink would be already created on your dashboard, which you can access from your merchant dashboard.

- Next, you should redirect your customer to this URL so the payment process can be finalized.

- After this, your customer would proceed normally with payment by choosing the preferred payment method (if available), and providing his card information.You Should Be Aware Of

It is not necessary for customers to pay with a card or bank account that matches the

cart_currency. Thecart_currencyparameter defines the currency in which the transaction will be settled. The customer's issuing bank will handle any necessary currency conversion at the applicable exchange rate. This ensures that customers can make payments in their preferred currency, while the transaction is processed in the specifiedcart_currency.

- Then, he will be redirected to his issuer bank 3DS/OTP page to authenticate the used card

- Finally, he would be redirect to a success/error page accordingly. By this time, you will be able to see his transaction on your merchant dashboard, whether it's accepted/authorized or not.Warning

If the transaction

cart_currencyfalls outside the "Transaction Amount Limit" set in the merchant's account, which defines the maximum and minimum amounts that can be processed in a single transaction, it will result in a transaction failure.

- As mentioned above in the How to use? section, as a merchant you would initiate a payment request per the above Specifications, same as the sample codes mentioned in the samples section above.

- Then, you will receive a response that includes the same

cart_currencyyou passed in the request payload, along with the redirect URL. This means you have initiated a correct payment request/page successfully.You Should Be Aware OfIt is not necessary for customers to pay with a card or bank account that matches the

cart_currency. Thecart_currencyparameter defines the currency in which the transaction will be settled. The customer's issuing bank will handle any necessary currency conversion at the applicable exchange rate. This ensures that customers can make payments in their preferred currency, while the transaction is processed in the specifiedcart_currency.{

"cart_currency": "SAR",

.

.

"redirect_url": "https://secure.paytabs.com/payment/page/52E5B6B*************B4818688",

.

.

} - Then, your customer will be redirected to his issuer bank 3DS/OTP page to authenticate the used card

- Finally, he would be redirect to a success/error page accordingly. And now, you will be able to see his transaction on your merchant dashboard, whether it's accepted/authorized or not.Warning

If the transaction

cart_currencyfalls outside the "Transaction Amount Limit" set in the merchant's account, which defines the maximum and minimum amounts that can be processed in a single transaction, it will result in a transaction failure.

- As mentioned above in the How to use? section, as a merchant you would initiate a payment request per the above Specifications, same as the sample codes mentioned in the samples section above.

- Then, you will receive a response that includes the same

cart_currencyyou passed in the request payload, along with the redirect URL. This means you have initiated a correct payment request/page successfully.You Should Be Aware OfIt is not necessary for customers to pay with a card or bank account that matches the

cart_currency. Thecart_currencyparameter defines the currency in which the transaction will be settled. The customer's issuing bank will handle any necessary currency conversion at the applicable exchange rate. This ensures that customers can make payments in their preferred currency, while the transaction is processed in the specifiedcart_currency.{

"cart_currency": "SAR",

.

.

"redirect_url": "https://secure.paytabs.com/payment/page/52E5B6B*************B4818688",

.

.

} - Then, your customer will be redirected to his issuer bank 3DS/OTP page to authenticate the used card

- Finally, he would be redirect to a success/error page accordingly. And now, you will be able to see his transaction on your merchant dashboard, whether it's accepted/authorized or not.Warning

If the transaction

cart_currencyfalls outside the "Transaction Amount Limit" set in the merchant's account, which defines the maximum and minimum amounts that can be processed in a single transaction, it will result in a transaction failure.